Thoughts on the Rapid and Persistent Beta Reversal

September 21, 2020

There are many measures of risk that investors rely on but few are as ubiquitous as beta. Beta, a simple measure of volatility calculated by regressing the past returns of an individual security relative to the broad market, is widely used by experts and non-experts alike as a gauge of the “riskiness” of a stock. In actuality, risk takes many forms and beta, by its very definition, is backward looking. In stable market environments it is theoretically possible to surmise that the best indicator of performance (or volatility) tomorrow is performance yesterday, but one thing I think all market participants can agree on right now is that this is not a stable market.

Beta and Stocks

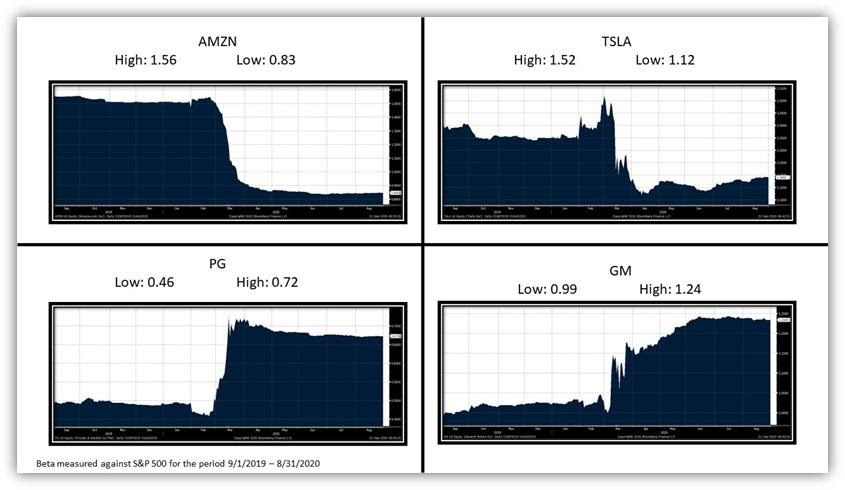

At the outset of COVID-19, markets saw a swift (and thus far persistent) change in the beta of many stocks with those of Technology companies taking a marked step down and those of other companies taking a similar step up (see the chart below for a sample) broadcasting to investors that these stocks are now “low risk”. Now, a case can be made for the fact that many of these Technology companies are benefitting most from the current “Work-from-Home” conditions but that would bely other financial risks inherent in these positions. These names have grown in market cap to dominate the indices of which they make up a greater share today than similar shares did even during the 1999-2000 Tech Bubble, increasing index concentration to peak levels. As valuation multiples continue to expand for these names, market participants need to be concerned about the lofty heights in the event of a reversal. The risk exacerbates if we take account of what could come from regulation as these companies continue to grow market share. While no investor can deign to know the direction of future markets with certainty we would caution investors to be aware of their risks and to be aware of the biases inherent in their measurement and analysis.

If you’d like to continue the discussion, please don’t hesitate to reach out to us.